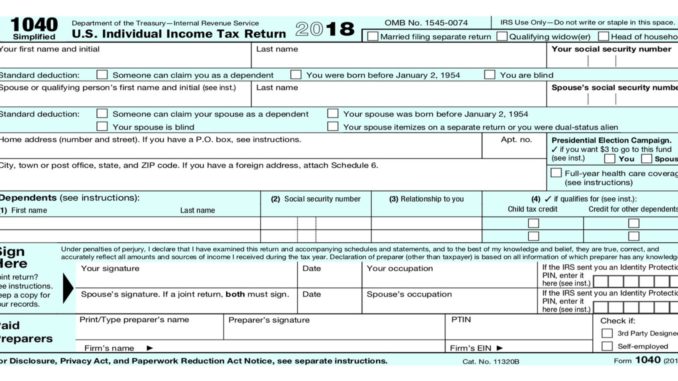

It’s January and if you are in business for yourself, which most WeMAR members are, it’s time to put together receipts and expenses along with income statements so your CPA can start putting together your taxes for filing by April 15, 2019.

The 2018 tax year is the first year under the new rules propagated by the tax reform legislation, Tax Cuts and Jobs Act of 2017. The changes will affect nearly every business and personal income tax filer. The IRS updates their website with these and other changes, so start there for more information.

Two IRS publications you will want to download and read are: What’s New for Your Business and Tax Reform Basics for Individuals and Families.

Here are some reminders of some of the changes:

Reduction of tax rates for business and individuals

Increased standard deduction and family tax credits

Reduced Alternative Minimum Tax

20% Qualified Business Income Deduction

100% Expensing for some business assets

Deductibility of meals and entertainment expenses

Changes to transportation expense deductibility

Moving expense reimbursements and deductibility

Quarterly Estimated Taxes

Earned Income Tax Credit

Residential rental property owners will see some changes as well. The IRS put out a Residential Rental fact sheet to help taxpayer understand these changes.

Those who performed a 1031 Exchange will want to read up on the significant changes made.

The IRS has a handy comparison chart to compare deductions, depreciation and expensing rule changes. Make sure to check this chart to find changes you need to know about.